Get the free nyc 400 form

Show details

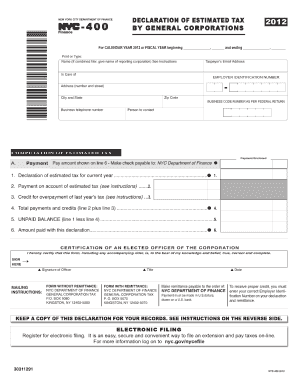

-400 NEW YORK CITY DEPARTMENT OF FINANCE *30311491* TM Finance ESTIMATED TAX BY GENERAL CORPORATIONS For CALENDAR YEAR 2014 or FISCAL YEAR beginning, and ending, Print or Type: Name (If combined filer,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your nyc 400 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nyc 400 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nyc 400 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form nyc 400. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out nyc 400 form

How to fill out NYC 400 online payment:

01

Go to the NYC Department of Finance website.

02

Click on the "Make a Payment" or "Pay Online" option.

03

Select the option for NYC 400 online payment.

04

Provide the required information, such as your name, address, and contact details.

05

Enter the required payment details, including the amount to be paid and the payment method.

06

Review the entered information and confirm the payment.

07

Receive confirmation of the payment, either through email or on the website.

Who needs NYC 400 online payment:

01

Any individual or business who owes money to the NYC Department of Finance.

02

Those who have received a notice, bill, or citation from the NYC Department of Finance.

03

Individuals or businesses that need to pay fines, fees, taxes, or any other financial obligation to the city of New York.

Fill nyc 400 fillable : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is nyc 400 online payment?

NYC 400 online payment refers to the online payment system used in New York City to pay fines or fees related to parking violations. It allows individuals to conveniently make their payments through the official website, saving them time and effort compared to making payments in person.

Who is required to file nyc 400 online payment?

The NYC 400 online payment is required to be filed by individuals or businesses who owe taxes or other fees to the City of New York. This includes individuals who owe personal income taxes, businesses that owe corporate taxes, as well as those who owe fees for permits, licenses, or other city services.

What is the purpose of nyc 400 online payment?

The purpose of NYC 400 online payment is to provide a convenient and streamlined platform for residents and businesses in New York City to make various payments online. This can include payments for services, fines, taxes, permits, licenses, and other fees related to city agencies and departments. It allows individuals and organizations to save time and effort by making payments electronically, rather than visiting physical locations or mailing checks.

What information must be reported on nyc 400 online payment?

The NYC 400 online payment platform requires the following information to be reported:

1. Amount: The exact amount to be paid online must be specified.

2. Payee Name: The name of the person or entity to whom the payment is being made.

3. Address: The address of the payee.

4. Account Number: The account number, if applicable, that the payment is associated with.

5. Purpose: The reason or purpose for the payment.

6. Transaction ID: A unique identification number assigned to each online payment transaction.

7. Date and Time: The date and time the payment is being made.

8. Payment Method: The payment method utilized for the online payment (E-check, credit card, etc.).

9. Contact Information: The name, email address, and phone number of the person making the payment for any follow-up communication.

10. Additional Notes: Any additional notes or comments related to the payment may be included.

When is the deadline to file nyc 400 online payment in 2023?

I apologize, but I'm not able to provide the specific deadline for filing the NYC 400 online payment in 2023. The deadline for filing taxes and related payments can vary each year and may be subject to change. It is recommended to check with the official NYC Department of Finance or consult a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of nyc 400 online payment?

The penalty for late filing of the NYC 400 online payment can vary depending on the specific circumstances. Generally, the penalty for late filing can be 0.5% of the net amount due for each month or part of a month that the payment is late, up to a maximum of 25%. However, it's recommended to check with the NYC Department of Finance or consult a tax professional for the most accurate and up-to-date information on penalties for late filing of NYC 400 payments.

How do I modify my nyc 400 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your form nyc 400 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send nyc 400 instructions for eSignature?

Once you are ready to share your nyc 400 instructions 2020, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I sign the nyc 400 online payment electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your nyc 400 2019 form in seconds.

Fill out your nyc 400 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nyc 400 Instructions is not the form you're looking for?Search for another form here.

Keywords relevant to nyc400 form

Related to nyc 400 2019 fillable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.